Digital application route - what is it?

Very few people can imagine what the technocratic term "digital application route" means. Yet the digital application route plays an important role millions of times a day (unnoticed). Whenever someone makes a transaction on the Internet (e.g. orders a pizza), the process has been made possible by a digital application route. Compared to this everyday meaning of the digital order process, there is comparatively little to be found about the term on the web.

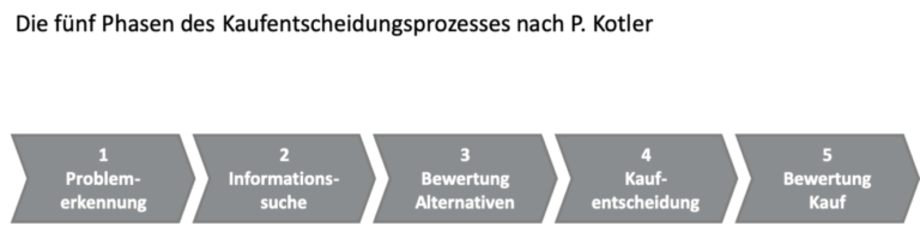

To approach the topic, it is worth taking an abstract and detailed look at the purchasing process. From a psychological perspective, the purchasing process can be divided into several phases. If, for example, Kotler's widely used, ideal-typical 5-phase model [1] is used to illustrate the buying process, the buying process is divided into five steps: problem identification, information search, evaluation of alternatives, purchase decision and evaluation of the purchase decision.[2] An illustration can be found in the following diagram:

Fig 1: The 5-phase model of the purchasing decision process according to Kotler, source: afb based on Kotler.

The model is of a general nature. It does not matter whether purchases are made in the real world or on the Internet. It was developed before the Internet became widespread. However, the model can also be applied to purchases on the Internet in a way that anyone can understand, as the following example shows: After a user has recognized their problem or need (phase 1), they start searching for the product using search engines, for example (phase 2), and visit various websites or aggregators, i.e. platforms (phase 3), in order to be able to evaluate the alternatives. Finally, a purchase decision (phase 4) is made and completed (e.g. via a store). The goods are then paid for, shipped, etc.

Fig 2: Digital application process within the framework of Kotler's 5-phase model, source: afb based on Kotler.

In Kotler's 5-phase model, the digital application process is mainly found in phase 3 and phase 4. It is the phase in which "it is important" that a user can smoothly become a digital customer. We can imagine a definition of the digital application process as follows: The digital application route is the technological solution or IT solution that provides the necessary steps so that the buyer in the digital world can legally effectively address their declaration of intent to the provider. Due to the high expectations of users, this must be done smoothly, above all without media discontinuity and with an excellent customer experience.

Areas of application or use cases of the digital application route

Digital application process for simple transactions

Many transactions can now be processed digitally very quickly and conveniently. Here, the digital application process is almost invisible, so to speak. The digital application process in these cases is very short and essentially consists of three modules: a product catalog makes it possible to select a product and add additional features (step 1), a comparison module allows you to compare it with alternatives (2) and the purchase decision is made possible by placing the desired item in the shopping cart (3). That's all there is to it.

Fig 3: Digital application route for simple products.

This simple form of digital application process was already technologically feasible for simple transactions in the early phase of internet distribution (keyword "e-commerce"). If you wanted to sell something over the Internet, you needed a store. The web store therefore also contains the digital application process.

Digital application process for financial services

A digital application process is particularly visible when the individual steps are more extensive and more steps are required to formulate a legally effective digital declaration of intent to purchase something ("application"). A good example is the financial services sector. Here, for example (when opening an account or applying for a loan), a signature must be provided and identity verified, creditworthiness must be checked, etc. This even goes so far that legal provisions must be adapted beforehand. Examples of this are the identification procedure and the electronic signature. For some years now, it has been possible for digital interested parties to identify themselves digitally and sign contracts electronically, among other things. Since 2014, the Federal Ministry of Finance has enabled the video identification procedure due to a new interpretation of Section 6 of the Money Laundering Act. Both the Post-Ident and Video-Ident procedures meet the legal standards of the Federal Financial Supervisory Authority.[3] With the Video-Ident procedure, customers identify themselves to the bank via a video call over the internet or an app on their smartphone. Customers must show a valid identity card or passport to the camera and answer questions to verify their identity and legitimacy.[4] In addition to the video identification procedure, electronic signatures are increasingly becoming the standard. The electronic signature links data that makes it possible to identify the signatory and verify the integrity of the signed electronic information. The electronic signature therefore fulfills the same purpose as a signature on a paper document.

Digital application route in the context of Retail Finance

Considering that it is possible, for example, to open an account with the above steps, the digital application process for credit products has to do even more. It becomes particularly challenging when the products themselves are already complex (because they first have to be configured, for example) and can be combined with financial services. The classic example here is the car loan: a car can already be configured in a variety of ways, combined with a number of financing products (e.g. financing, leasing), which in turn can also be configured in a number of variants. There are also additional products such as insurance, mobility services, etc.

Even if the digital application process for these transactions is greatly simplified, it still looks much more extensive than the one in Figure 2:

Fig 4: Digital application route for products with Retail Finance, source: afb.

As I said, this is only intended to illustrate the principle here - in practice, there are many other steps behind these steps. Read more about this in Automotive Finance.

Digital application process for real estate financing

Compared to other financial services (such as opening a bank account), real estate financing is also a complex business area in terms of digitalization. Real estate is one of the most "expensive" and complex "products" that can now be financed fully digitally. The purchase of a property has implications for a large number of financing options, official regulations, documents to be submitted, etc. In addition, potential buyers have an increased need for security. After all, for most people, buying a property only comes into question once in a lifetime, if at all. Potential buyers have the same expectations of the "shopping experience" with digital real estate financing as they are already accustomed to from the digital purchase of consumer goods (see Chapter 3 of this wiki article).

The list of requirements from prospective buyers poses major challenges for providers of digital real estate financing. In the case of real estate financing in particular, the individual points can involve complex and extensive processes. They represent hurdles for digitalization that need to be overcome. A high conversion rate can only be achieved by offering an outstanding customer experience throughout the entire process. For a long time, however, most traditional providers were far from being able to master the above steps with their IT.

Drivers for the further development of the digital application route

The digital application process is becoming ever more extensive, sophisticated and customer-friendly. This is caused by a spiral of the following three factors:

a) Customer expectations

The customer is the main driver. Even such a complex process as real estate financing must be carried out according to the KISS ("Keep it simple and stupid") principle from the perspective of digital buyers. It should be as simple as ordering a book. This essentially contains the following five implications that the digital application process must fulfill:

- Convenient access via all devices to all financing options;

- experimental, even playful determination of the right offer;

- immediate help in the digital purchasing process if required;

- no spatial or media breaks, e.g. when submitting documents;

- no waiting times, e.g. for decisions or approvals.

b) Digitalization/technological possibilities

Progress on the technological side quickly ensures that the spiral continues to accelerate. With increasingly complex digital contracts, it is important that they can be concluded without media discontinuity. "A media disruption occurs in information processing when data/information (has to) be transferred from one information medium to another in the transmission chain of a process."

Platforms play a special role as additional accelerators. They ensure that the wishes of providers increase more and more because, for example, they also offer comparisons and additional services across all providers.

c) Type of customer acquisition

The digital application process replaces the personal sales meeting and is therefore the central element for acquiring new customers. It is the direct tool for communicating with a potential buyer. A customized application process that responds to the customer's needs increases the conversion rate and therefore has a significant impact on a company's success. This means that providers are also increasing their efforts in this area. This is vital, as the user must be kept on board during this critical phase.

It should be added here that it is simplistic to say: "Everything is now digital." The other sales channels still exist. For example, many people still treat themselves to a test drive and want to sit in the car, so showrooms are still important. Similarly, real estate financing shows that personal advice is expressly desired for certain steps. Even if the importance of the individual channels has shifted, they still exist in parallel. Providers must therefore also ensure that the digital application process interacts as smoothly as possible with the other channels (omnichannel approach).

Differentiation from digital customer onboarding

The digital application process is closely related to the phenomenon of customer onboarding or digital customer onboarding. This is about the process of how customers can be acquired digitally in such a way that satisfaction with the process is so high that customers are happy to remain customers. So you have two terms that focus on the same phase: What happens digitally once someone has decided to become a customer? As you would expect, it is difficult to make a clear distinction. The terms should rather be understood as two perspectives on the same process.

We differentiate between them as follows:

- Digital Customer Onboarding is more of a desire, the digital application route is more of a solution.

- Digital customer onboarding is more the overall process, the digital application route is more the technological basis.

- The digital application process is the enabler for successful customer onboarding.

In this short explanatory video, you will learn in 2 minutes what digital customer onboarding in the B2C sector is all about.

Sources

[1] Keyword: Buyer behavior model according to P. Kotler. In: BWL-Lexikon, www.bwl-lexikon.de/wiki/kaeuferverhalten/

[2] Keyword: Purchase decision. In: Gabler Wirtschaftslexikon, wirtschaftslexikon.gabler.de/definition/kaufentscheidung-38414

[3] WELT (2014): "This is how opening an account by video works", www.welt.de/finanzen/article160309141/So-funktioniert-die-Kontoeroeffnung-per-Video.html

[4] BaFin (2019): " Misuse of the Video-Ident procedure: How can I protect myself against fraudulent account opening?", www.bafin.de/SharedDocs/FAQs/DE/Verbraucher/Bank/Allgemeines/01_Video_Ident_Betrug.html