What is Wholesale finance?

Today, manufacturers and retailers are confronted with the customer requirement that, in addition to a live presentation of products at the point of sale, short delivery times are also expected. Despite the increasing importance of online retail and constantly improving possibilities for online presentation, such as test drives using virtual reality [1], it remains important for many buyers of high-quality goods (e.g. cars, kitchens, furniture) to be able to inspect and touch the object of their desire live.

For this reason, many industries have to maintain appropriate stocks. They tie up liquid funds and cause financing costs. In the automotive industry, for example, the capital investment per object is particularly high, depending on the make and orientation of the dealer.

In order to optimize the funds tied up in purchasing/warehousing and the capital costs, retailers can make use of appropriate financing. Against this background, Wholesale finance is also referred to as inventory financing. Other terms such as merchandise or retailer purchase financing are also used synonymously in practice.

Wholesale finance variants

Classic Wholesale finance

In principle, classic Wholesale finance works as follows: A framework agreement is concluded between the retailer and the financing entity (for example, a bank). Depending on the purchase financing program, the retailer is granted a payment term that is usually between at least 90 days and up to 720 days. The purchase financing volume is based on the total value of the stock. It is lent at a certain rate (e.g. 80%). This capital injection in conjunction with the long payment term ensures that the retailer can sell the goods on the market, ideally before the Wholesale finance matures. Repayment is made in installments after the due date. This ensures liquidity for the purchase.

Banks specializing in asset finance (e.g. captives, specialist banks) offer purchase financing programs within a range of services. For example, synergy effects in the form of interest savings can result when purchasing and Retail Finance are coupled. Specialist banks generally offer additional services, such as support with the management of collateral. Furthermore, the financiers ensure that the organizational interaction between these processes at the retailer is improved. As a rule, they have corresponding IT-controlled automated mechanisms that they make available to the retailers.

Wholesale finance as reverse factoring

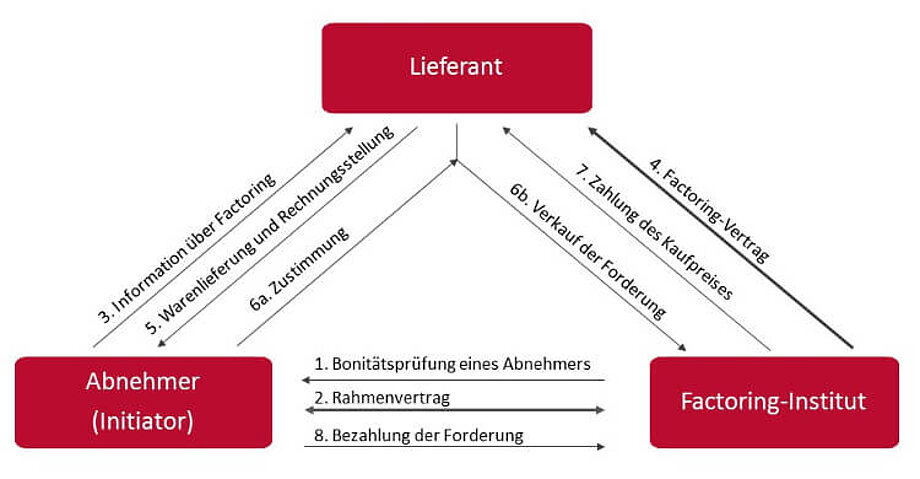

There are now also varieties of factoring that are classified as Wholesale finance. Instead of buying or financing receivables that arise for a company due to the sale of services, as is the case with classic factoring variants, so-called reverse factoring is aimed at the supplier side of the company. The object of consideration is therefore not the factoring customer's receivables, but its supplier liabilities. For this reason, this "reverse" factoring procedure is also known as reverse or supplier factoring. At this point, we will only refer to the existence of this form of financing and illustrate it briefly using the following diagram:

Fig. 1: Based on: Wagner, Stefan: Reverse factoring process

Providers of this form of Wholesale finance are primarily factoring specialists. They can also offer their factoring partners an extended service and release synergy effects if reverse factoring is combined with classic factoring variants [2].

Wholesale finance as finetrading

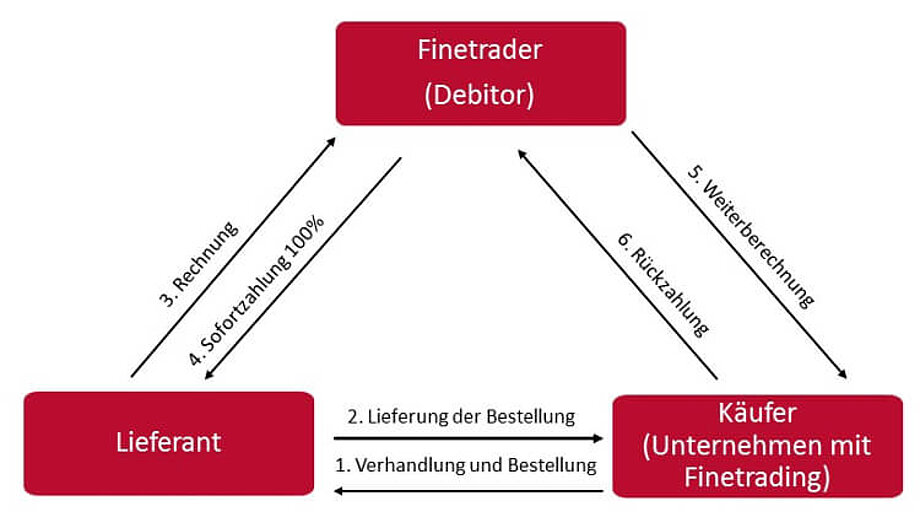

Wholesale finance is also used in the form of finetrading, which is still new in Germany. Finetrading means nothing other than "intermediate trade". Another company acts as an intermediary between the retailer and supplier. Accordingly, the definition of finetrading on Wikipedia reads: "Finetrading is a service that enables companies that require goods or raw materials for their production or service provision to professionally outsource their purchasing. The service provider (finetrader) acts on the one hand as an intermediary because it acquires the goods at the behest of the buyer of the goods and on the other hand as a financier because it pre-finances this trading transaction until the buyer of the goods pays it." [3]

There are many detailed articles on the subject of finetrading on the web. At this point, we will only refer to the existence of finetrading in the context of Wholesale finance. The basic principles of how it works are shown schematically in the following diagram:

Fig 2: Based on: Wikipedia: Finetrading process

Importance and advantages of Wholesale finance

Alternative forms of financing such as Wholesale finance or finetrading are becoming increasingly popular [4]. This is not least due to the fact that fewer and fewer companies are able to make use of overdraft facilities from their bank or supplier credit. These financing instruments, which have actually been tried and tested over many decades, have been subject to increased erosion in the last decade. Bank loans as a purchasing financing instrument have become increasingly expensive for retailers due to the capital requirements of Basel II in conjunction with the 2008 financial crisis [5]. Supplier credits have also become less attractive as discount rates have risen in recent years.

The advantages of the Wholesale finance variants described here are generally as follows:

- retailers can make better use of cash discounts and rebates

- a larger product selection ensures better sales

- the current account is relieved

- the negotiating position with the house bank is improved

- there is a higher stock turnover and a correspondingly higher sales frequency

Wholesale finance industries

Wholesale finance is usually used where inventories are created. Wholesale finance is typically used in the following industries [6]:

- Trade

- Chemicals

- Mechanical engineering

- Print & media

- IT/EDP

Wholesale finance in the age of digitalization

In view of the growing importance of online retail, the question arises as to whether Wholesale finance will retain its importance in the digital age. The answer is clearly "yes": online-only retailers must also respond to customer expectations for fast delivery. Wholesale finance also plays an important role in the digital world. This is due to all the players and elements that characterize a digital story: Amazon, fintech, online reviews and digital customer experience. The story of Wholesale finance in the digital age is as follows:

Amazon merchants (regardless of whether they are Amazon Sellers or Amazon Vendors) have the following problem: If things are going well and the products are selling well, this is gratifying on the one hand. On the other hand, prompt subsequent delivery is more important than ever. There are several reasons for this: Fulfilling customer wishes, generating positive reviews, strengthening the partnership with Amazon and, above all, maximizing sales. The associated financing problem is reminiscent of the example of car dealers mentioned at the beginning of this article: as it can take a long time for the revenue to actually be booked to the Amazon merchant account, dealers have to make financial advance payments for a new purchase of goods. The problem of liquidity bottlenecks is shared by Amazon sellers and Amazon merchants alike. Amazon sellers in particular are expected by Amazon to be extraordinarily fast in terms of delivery capability and, in particular, large delivery quantities. At the same time, the payment term for invoices to Amazon is up to 90 days, which must first be bridged if goods are to be purchased at the same time. FinTech amacash has specialized in precisely this need: It offers Wholesale finance specifically tailored to Amazon sellers and Amazon merchants [7].

Sources

1 Schwedes, Larissa (2017): The test drive remains analog (12.12.2017), www.esslinger-zeitung.de/region/stuttgart_artikel,-die-probefahrt-bleibt-analog-_arid,2167506.html

2 Wagner, Stefan (2008): Using reverse factoring to specifically optimize wholesale finance, FLF 6/2008, www.factoring.de/sites/default/files/Wagner_FLF%206-08_S.281-282.pdf

3 In Wikipedia, Die freie Enzyklopädie: Finetrading, edit date: 23.9.2017, de.wikipedia.org/w/index.php

4 Autohaus (2015): Wholesale finance for dealers flourishes, Credit Banks section (29.04.2015), www.autohaus.de/nachrichten/kreditbanken-einkaufsfinanzierung-fuer-haendler-floriert-1632956.html

5 European Central Bank (2010): Impact of the financial crisis on the financial sector: lessons and consequences (4.10.2010), www.ecb.europa.eu/press/key/date/2010/html/sp101004.de.html

6 Elbe-Finanzgruppe (2017): Wholesale finance - The flexible solution for your purchasing, www.elbe-finanzgruppe.de/finetrading/finetrading-loesungen/einkaufsfinanzierung

7 Ottersbach, Thomas (2017): amacash: How the new financing solution supports Amazon retailers! (07.08.2017), www.ecommerce-vision.de/amacash-so-unterstuetzt-die-neue-finanzierungsloesung-amazon-haendler/