Today, the automotive industry's financial services providers make a significant contribution to securing the entire automotive value chain and are a key system stabilizer in the automotive industry. However, the successful business model must face up to changing customer needs and the challenges of increasing digitalization.

Today, automotive financial services are an integral part of the vehicle purchase process for both private and commercial customers. Around three quarters of all new vehicles in Germany are put on the road via leasing and financing models, which corresponds to an annual credit volume of around 47.7 billion euros. The car manufacturers' own financial service providers, which have joined forces in the "Arbeitskreis der Banken und Leasinggesellschaften der Automobilwirtschaft (AKA)", are the undisputed market leaders in this area: of the approximately 2.25 million new vehicles that were financed or leased last year, over 1.3 million are on the books of the manufacturers' banks. An economically relevant banking group has grown up almost silently here, which, albeit in the background, makes a significant contribution to securing the entire automotive value chain and acts as a key system stabilizer for the automotive industry.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

For decades, manufacturer-affiliated financial service providers have placed the mobility of their customers at the heart of their products and services. Their special business model is not aimed at maximizing lending, but at enabling vehicle buyers to finance vehicles tailored to their individual needs. In this way, automotive banks support the vehicle sales of their manufacturer groups and contribute to the long-term brand and dealer loyalty of customers, as recent AKA study results once again underline.

Financial services, for example, significantly increase vehicle turnover for manufacturers and dealers: customers of manufacturer banks use their vehicles for an average of 4.4 years, while leasing customers only use them for 3.1 years. In contrast, the vehicle holding period for cash payers is significantly longer at 5.9 years.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

The range of financial services also has a decisive influence on customers' actual choice of vehicle. Customers of manufacturer-affiliated banks and leasing providers not only buy their vehicle earlier than planned, they also equip it better and often choose a larger model than originally planned. Last but not least, manufacturer-affiliated financial services also make it possible for almost four out of ten prospective used car buyers to decide to purchase a new car after all.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

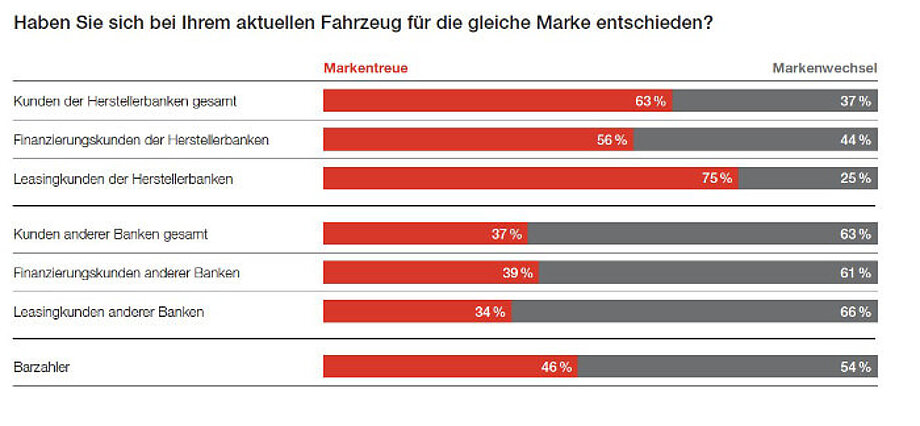

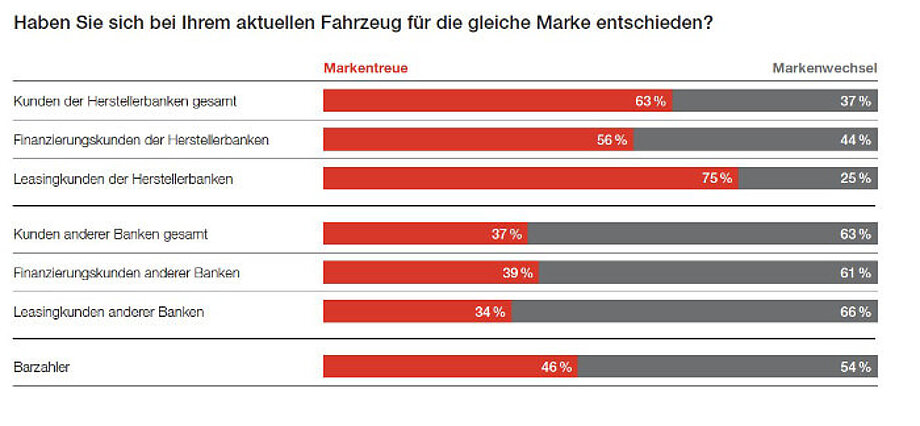

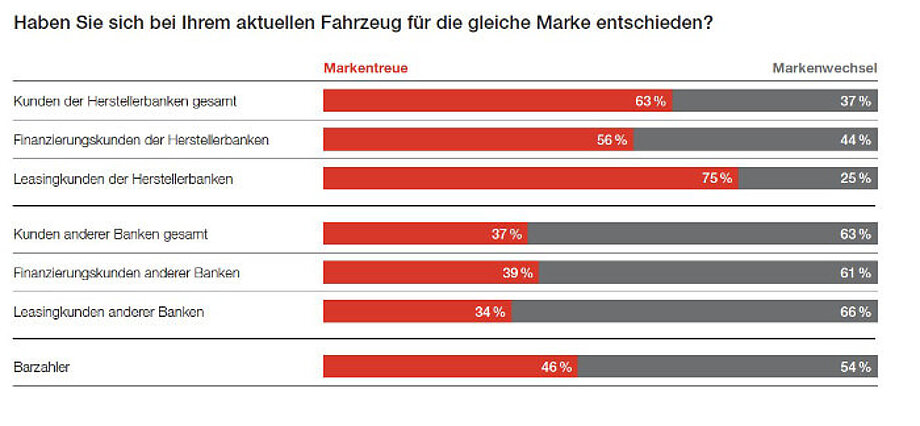

The product offers of the manufacturer banks also generate customer loyalty through their mechanics, which simply cannot be achieved through the cash sale of a vehicle. Car bank customers remain loyal to their vehicle brand and their car dealer much more frequently than cash payers. In a direct comparison with other banking groups active in the automotive market, the manufacturer banks also occupy a leading position here.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

Nevertheless, the manufacturing banks must not rest on the success of their business model! The industry is on the move and is being influenced by two current megatrends in particular. These are, on the one hand, customers' changing mobility needs and, on the other, increasing digitalization in all areas.

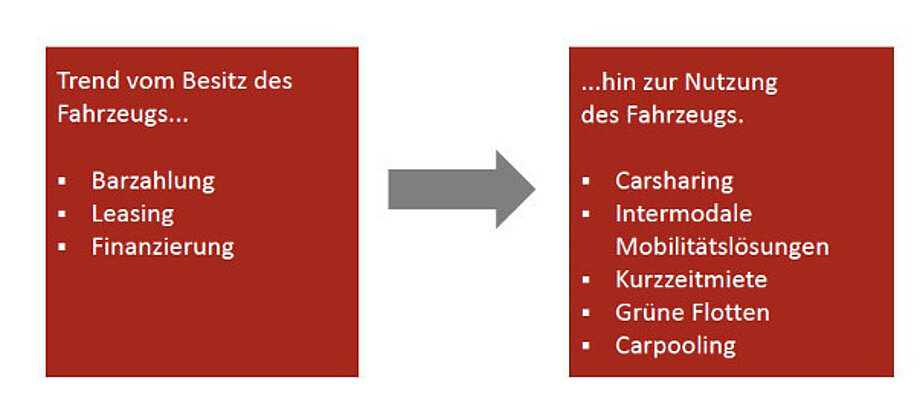

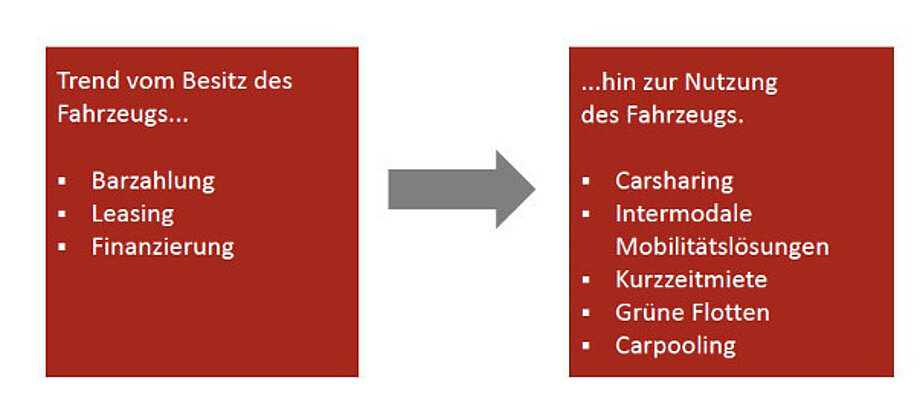

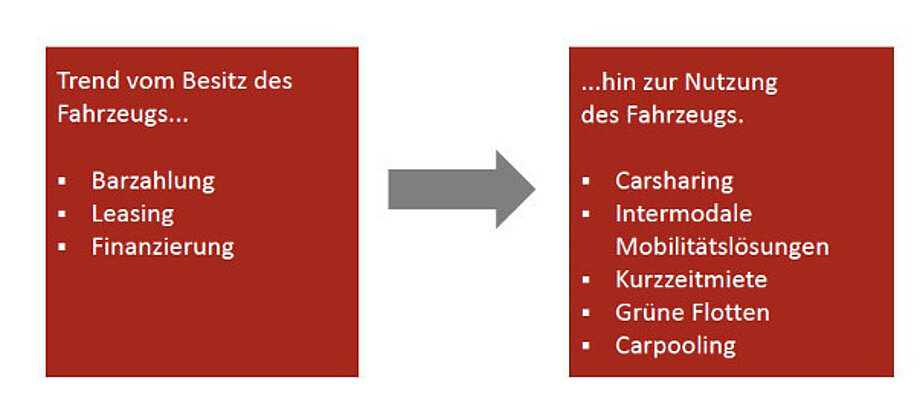

The changing, ever more demanding customer and mobility needs, which are increasingly based on the principle of "using instead of owning" in the age of the share economy, represent both an opportunity and a challenge for the industry. Car manufacturers' banks already have new offers for customers' individual mobility. Whether "car2go" from Daimler, "Quicar" from Volkswagen, or "Mu by Peugeot" and "multicity" from Citroën, they all have one thing in common: all concepts have been launched in close cooperation with their own financial subsidiaries. This development will continue and the role of financial service providers will become even more important. Not least because new mobility offers are also closely linked to new forms of drive, such as e-mobility, which must be affordable for customers.

Trend towards using instead of owning:

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

Banks in the automotive industry and the automotive trade as their exclusive sales channel are facing major challenges in the area of digitalization. Players from outside the industry are increasingly penetrating the automotive financial services sector or key sub-sectors. Whether online new car exchanges promising discounts, less objective comparison portals, alternative providers for peer-to-peer lending or other FinTechs, they are all having a disruptive effect on the existing business model of automotive banks and traditional dealerships from the Internet.

The automotive industry must not run the risk of being overtaken on the right and is challenged to keep pace with changing customer needs. A key to success lies in the closer integration of offline and online offerings. This ranges from professional lead management, a consistent expansion of brand-specific online calculators, the expansion of advance credit confirmations through to our own digital vehicle and financing portals with real offer prices. The first corresponding offerings from AKA members are already available, such as the Volkswagen Leasing Exchange or the Mercedes-Benz Online Store, but development will continue at a rapid pace. Manufacturers, dealers and financial service providers must work closely together and pull in the same direction.

Source

1 Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential. Cologne

Today, the automotive industry's financial services providers make a significant contribution to securing the entire automotive value chain and are a key system stabilizer in the automotive industry. However, the successful business model must face up to changing customer needs and the challenges of increasing digitalization.

Today, automotive financial services are an integral part of the vehicle purchase process for both private and commercial customers. Around three quarters of all new vehicles in Germany are put on the road via leasing and financing models, which corresponds to an annual credit volume of around 47.7 billion euros. The car manufacturers' own financial service providers, which have joined forces in the "Arbeitskreis der Banken und Leasinggesellschaften der Automobilwirtschaft (AKA)", are the undisputed market leaders in this area: of the approximately 2.25 million new vehicles that were financed or leased last year, over 1.3 million are on the books of the manufacturers' banks. An economically relevant banking group has grown up almost silently here, which, albeit in the background, makes a significant contribution to securing the entire automotive value chain and acts as a key system stabilizer for the automotive industry.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

For decades, manufacturer-affiliated financial service providers have placed the mobility of their customers at the heart of their products and services. Their special business model is not aimed at maximizing lending, but at enabling vehicle buyers to finance vehicles tailored to their individual needs. In this way, automotive banks support the vehicle sales of their manufacturer groups and contribute to the long-term brand and dealer loyalty of customers, as recent AKA study results once again underline.

Financial services, for example, significantly increase vehicle turnover for manufacturers and dealers: customers of manufacturer banks use their vehicles for an average of 4.4 years, while leasing customers only use them for 3.1 years. In contrast, the vehicle holding period for cash payers is significantly longer at 5.9 years.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

The range of financial services also has a decisive influence on customers' actual choice of vehicle. Customers of manufacturer-affiliated banks and leasing providers not only buy their vehicle earlier than planned, they also equip it better and often choose a larger model than originally planned. Last but not least, manufacturer-affiliated financial services also make it possible for almost four out of ten prospective used car buyers to decide to purchase a new car after all.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

The product offers of the manufacturer banks also generate customer loyalty through their mechanics, which simply cannot be achieved through the cash sale of a vehicle. Car bank customers remain loyal to their vehicle brand and their car dealer much more frequently than cash payers. In a direct comparison with other banking groups active in the automotive market, the manufacturer banks also occupy a leading position here.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

Nevertheless, the manufacturing banks must not rest on the success of their business model! The industry is on the move and is being influenced by two current megatrends in particular. These are, on the one hand, customers' changing mobility needs and, on the other, increasing digitalization in all areas.

The changing, ever more demanding customer and mobility needs, which are increasingly based on the principle of "using instead of owning" in the age of the share economy, represent both an opportunity and a challenge for the industry. Car manufacturers' banks already have new offers for customers' individual mobility. Whether "car2go" from Daimler, "Quicar" from Volkswagen, or "Mu by Peugeot" and "multicity" from Citroën, they all have one thing in common: all concepts have been launched in close cooperation with their own financial subsidiaries. This development will continue and the role of financial service providers will become even more important. Not least because new mobility offers are also closely linked to new forms of drive, such as e-mobility, which must be affordable for customers.

Trend towards using instead of owning:

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

Banks in the automotive industry and the automotive trade as their exclusive sales channel are facing major challenges in the area of digitalization. Players from outside the industry are increasingly penetrating the automotive financial services sector or key sub-sectors. Whether online new car exchanges promising discounts, less objective comparison portals, alternative providers for peer-to-peer lending or other FinTechs, they are all having a disruptive effect on the existing business model of automotive banks and traditional dealerships from the Internet.

The automotive industry must not run the risk of being overtaken on the right and is challenged to keep pace with changing customer needs. A key to success lies in the closer integration of offline and online offerings. This ranges from professional lead management, a consistent expansion of brand-specific online calculators, the expansion of advance credit confirmations through to our own digital vehicle and financing portals with real offer prices. The first corresponding offerings from AKA members are already available, such as the Volkswagen Leasing Exchange or the Mercedes-Benz Online Store, but development will continue at a rapid pace. Manufacturers, dealers and financial service providers must work closely together and pull in the same direction.

Source

1 Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential. Cologne

Today, the automotive industry's financial services providers make a significant contribution to securing the entire automotive value chain and are a key system stabilizer in the automotive industry. However, the successful business model must face up to changing customer needs and the challenges of increasing digitalization.

Today, automotive financial services are an integral part of the vehicle purchase process for both private and commercial customers. Around three quarters of all new vehicles in Germany are put on the road via leasing and financing models, which corresponds to an annual credit volume of around 47.7 billion euros. The car manufacturers' own financial service providers, which have joined forces in the "Arbeitskreis der Banken und Leasinggesellschaften der Automobilwirtschaft (AKA)", are the undisputed market leaders in this area: of the approximately 2.25 million new vehicles that were financed or leased last year, over 1.3 million are on the books of the manufacturers' banks. An economically relevant banking group has grown up almost silently here, which, albeit in the background, makes a significant contribution to securing the entire automotive value chain and acts as a key system stabilizer for the automotive industry.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

For decades, manufacturer-affiliated financial service providers have placed the mobility of their customers at the heart of their products and services. Their special business model is not aimed at maximizing lending, but at enabling vehicle buyers to finance vehicles tailored to their individual needs. In this way, automotive banks support the vehicle sales of their manufacturer groups and contribute to the long-term brand and dealer loyalty of customers, as recent AKA study results once again underline.

Financial services, for example, significantly increase vehicle turnover for manufacturers and dealers: customers of manufacturer banks use their vehicles for an average of 4.4 years, while leasing customers only use them for 3.1 years. In contrast, the vehicle holding period for cash payers is significantly longer at 5.9 years.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

The range of financial services also has a decisive influence on customers' actual choice of vehicle. Customers of manufacturer-affiliated banks and leasing providers not only buy their vehicle earlier than planned, they also equip it better and often choose a larger model than originally planned. Last but not least, manufacturer-affiliated financial services also make it possible for almost four out of ten prospective used car buyers to decide to purchase a new car after all.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

The product offers of the manufacturer banks also generate customer loyalty through their mechanics, which simply cannot be achieved through the cash sale of a vehicle. Car bank customers remain loyal to their vehicle brand and their car dealer much more frequently than cash payers. In a direct comparison with other banking groups active in the automotive market, the manufacturer banks also occupy a leading position here.

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

Nevertheless, the manufacturing banks must not rest on the success of their business model! The industry is on the move and is being influenced by two current megatrends in particular. These are, on the one hand, customers' changing mobility needs and, on the other, increasing digitalization in all areas.

The changing, ever more demanding customer and mobility needs, which are increasingly based on the principle of "using instead of owning" in the age of the share economy, represent both an opportunity and a challenge for the industry. Car manufacturers' banks already have new offers for customers' individual mobility. Whether "car2go" from Daimler, "Quicar" from Volkswagen, or "Mu by Peugeot" and "multicity" from Citroën, they all have one thing in common: all concepts have been launched in close cooperation with their own financial subsidiaries. This development will continue and the role of financial service providers will become even more important. Not least because new mobility offers are also closely linked to new forms of drive, such as e-mobility, which must be affordable for customers.

Trend towards using instead of owning:

Source: Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential [1]

Banks in the automotive industry and the automotive trade as their exclusive sales channel are facing major challenges in the area of digitalization. Players from outside the industry are increasingly penetrating the automotive financial services sector or key sub-sectors. Whether online new car exchanges promising discounts, less objective comparison portals, alternative providers for peer-to-peer lending or other FinTechs, they are all having a disruptive effect on the existing business model of automotive banks and traditional dealerships from the Internet.

The automotive industry must not run the risk of being overtaken on the right and is challenged to keep pace with changing customer needs. A key to success lies in the closer integration of offline and online offerings. This ranges from professional lead management, a consistent expansion of brand-specific online calculators, the expansion of advance credit confirmations through to our own digital vehicle and financing portals with real offer prices. The first corresponding offerings from AKA members are already available, such as the Volkswagen Leasing Exchange or the Mercedes-Benz Online Store, but development will continue at a rapid pace. Manufacturers, dealers and financial service providers must work closely together and pull in the same direction.

Source

1 Working Group of Banks and Leasing Companies in the Automotive Industry (AKA) (2016). Automotive banks 2016 - Sales promotion, worry-free mobility, customer loyalty, potential. Cologne