Projects for digital transformation and greater customer focus continue to be a priority for many companies. The necessary coordination of both project goals increases the demands on implementation and rarely succeeds in practice: Studies show that many companies drive digital transformation in the interests of the IT departments, but forget the customer in the process. A seemingly successful digital transformation then drives customers and potential customers away.

A good onboarding process achieves two goals: Digitization and customer orientation

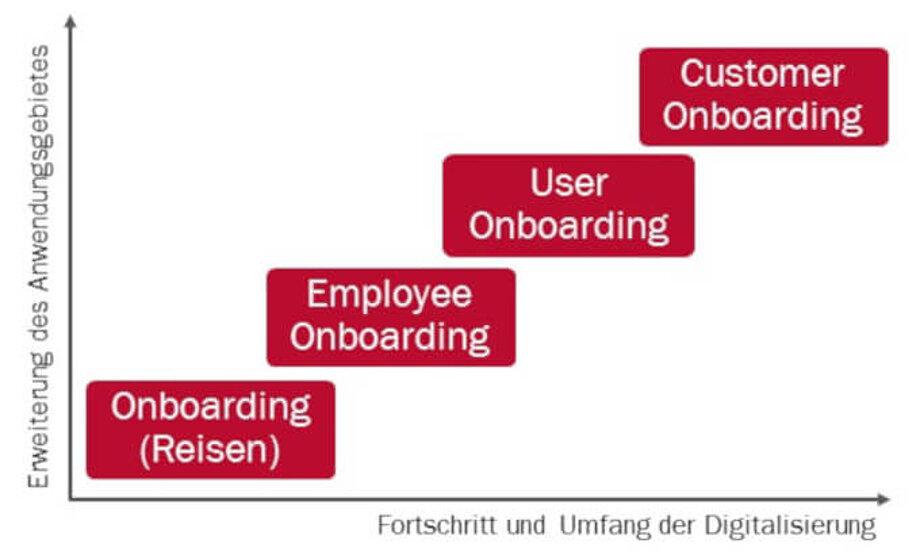

In the search for concrete action implications and guidelines that unite both trends a priori, one ends up with customer onboarding. Onboarding is a term that everyone knows from air travel. With employee onboarding, HR departments have already installed fixed processes for turning applicants into good employees. Based on this, customer onboarding is about how to generate good customers from interested parties.

If you succeed in establishing good customer onboarding in the company, you have automatically taken a big step towards a successful digital transformation in the service of the customer. If this connection holds true, then customer onboarding would be a concrete ideal way to combine the two abstract and complex phenomena of digital transformation and customer orientation in an exemplary manner.

The following section describes who customer onboarding can really help and how it must be designed to work.

What is customer onboarding?

Onboarding is a very important topic for airlines.

"Here is your boarding pass! Take it to gate XY 23." Everyone who has ever flown knows this sentence. You don't think about it, it's part of the routine when flying. But: it's not really a matter of course. Perhaps you remember your first flights. Did you ask yourself why you need another "ticket" now - after all, you've already taken one to the airport. And did you wonder why you had to buy another boarding pass with your flight ticket?

Even this minor irritation essentially demonstrates the need to remove any uncertainty from customers. Airlines have been working on the optimal onboarding process for decades: How do you make the process of becoming a customer particularly pleasant? This involves far more than the need to purchase two "tickets" described at the beginning. There are many other "disruptive factors" that can occur until you have completed your flight with satisfaction, such as baggage, gate, waiting times, intermediate transportation, etc. At each of these many intermediate stops, there is the threat of trouble, which practically every traveler has experienced at least once. This is why airlines are constantly refining the onboarding process.

From onboarding to customer onboarding

One area of a company that recognized the benefits of structured onboarding early on is the HR department. The HR department has launched an employee onboarding process. The aim here is to turn an applicant into an employee. Today, it is a proven and integral part of professionally organized HR departments.

Other sectors have already adapted this process to their own challenges. The IT industry, especially the providers of Software-as-a-Service (SaaS), quickly realized that it can be a rocky road between the first click and the conclusion of a contract. This is how "user onboarding" was born.

Does it make sense to extend the idea of onboarding to all sectors? Yes, because every company has a website and wants to attract potential customers there. The idea of customer onboarding (or alternatively client onboarding) can therefore be summarized in one sentence: It is about establishing a process that transforms prospective customers into satisfied customers.

Figure 1: Evolution of onboarding

Who is customer onboarding relevant for?

Customer onboarding has always been relevant for industries in which the chain between prospective customer and satisfied customer is separated in terms of time or location. A right to a service is acquired, i.e. a trip, a visit to a concert or an insurance policy. And at a later point in time and at a different location, the right to the service is redeemed.

To stay with the everyday case of a trip: Until a few years ago, a rail passenger had to buy a paper ticket at a ticket counter or from a ticket machine. This was validated manually by a conductor on the train. On local services, there were soon automatic stamps at the ticket validator. The option of reserving a seat made traveling more convenient, but onboarding more complicated.

Today, train tickets can be purchased using a smartphone and the QR code is scanned by the train attendant for validation. But there are innovations here too: Since May 2018, passengers on some Deutsche Bahn connections have been able to validate their cell phone ticket themselves when boarding.

There are therefore a large number of small intermediate steps that determine whether an experience is perceived positively by the consumer when purchasing a service and when using the purchased service. Business management has introduced the term "customer touchpoints" for this purpose. Providers have - intentionally or unintentionally - lost sight of many of these customer touchpoints as soon as the consumer has "signed up".

While onboarding for rail or air travel is still relatively simple, the conclusion of credit or insurance contracts can quickly become complicated. This is because other institutions often come into play before the contract is even concluded, for example for a credit check, and the regulatory requirements, such as the Money Laundering Act, are strict. Perhaps the complexity of customer onboarding at banks and insurance companies is also a reason why the digitalization of business processes for customer acquisition is still lagging behind other sectors.

For providers of SaaS solutions, for example, customer onboarding is becoming an important differentiating factor in the face of tough competition: good onboarding service gives hope for a longer-term business relationship, especially for services and products that require explanation.

Of course, this positive effect can also occur with products that require less explanation, but it tends to be less pronounced [1]. In these cases, it is less important for the customer onboarding process to sell a specific product or service directly. Rather, the aim is to build a relationship or, at best, even a relationship of trust and to systematically reduce customer turnover [2] and increase the recommendation rate.

Even more efficient with digital customer onboarding

An efficient customer onboarding process ultimately has a decisive impact on a company's profits and is particularly important for financial service providers in dynamic markets with strong competition, high regulatory requirements and fixed costs [3]. With a well thought-out, customer-oriented onboarding program, a positive return on investment (ROI) of five to one, ten to one or even higher can be expected on a regular basis [2].

Interim conclusion: Customer onboarding is relevant for practically every company. After all, the trend towards being able to offer and sell a wide range of services via digital processes anywhere and at any time is unbroken and affects all industries. In a digital world, consumers make their purchasing decisions independently of opening and consultation times. They expect a largely freely configurable offer process that optimally meets their purchasing and financing requirements.

An end-to-end digital business process for customer acquisition, also known as customer onboarding, is therefore essential for providers of products and services. Digital customer onboarding creates the basis for new product and solution offerings through the automation of business processes.

Digitalization and customer orientation go hand in hand, but often with frictional losses. The demand that digital transformation must be put at the service of the customer is understandable, but there are studies that prove exactly the opposite, such as the study by Hendricks, Rost & Cie: they come to the conclusion that an excessive focus on the use of IT leads to a loss of focus on customer orientation [4].

Figure 2: Added value of customer onboarding

Registration process as the first neuralgic point

The partial overlap between digitalization and customer orientation can be seen in the customer onboarding process. Particularly in the very first step of customer identification: digitalization has naturally led to a situation where there is no personal contact in the real world during the initial contact.

A good example of this development is the introduction of "online banking" around 25 years ago. Until the early 90s of the 20th century, you went to a bank branch to open a bank account. There you showed your ID card to the bank employee to be identified as the person you claimed to be. It was only through this step that you became a customer.

And then the unstoppable triumph of the Internet began. This flexible customer channel fueled the consumer's desire to do everything online, preferably at home. However, if a prospective customer wanted to use the online registration process, they found that they first had to make a large number of entries before receiving the following information: "We will send you a form that you should take to a post office." The joy of having to queue up to explain his request to the postal workers was limited. Wouldn't it have been easier and quicker to go to a bank branch after all?

The first critical point in the customer onboarding process is registration. This is where most potential customers are still lost. This is a difficult realization to bear in view of the fact that the consumer has just given the "green light" to become a customer. The reason for this is a mixture of psychological and technical hurdles.

Smartphones and apps as a welcome enabler

Smartphones and apps have significantly lowered these hurdles. Hardware and software have become simpler and more user-friendly. And registration has become a matter of course in all conceivable sectors and use cases. The willingness to register has increased and the resistance of consumers to enter their data has decreased. Nevertheless, the registration process remains a customer touchpoint that is very important for first-class service in customer onboarding.

The customer onboarding process

There is no generally applicable process for customer onboarding. It is similar from airline to airline and from destination to destination, but differs in detail. Customer onboarding also varies from industry to industry.

Before even starting with the company-specific design of the customer onboarding process, it is important to set goals for your own customer onboarding program. It is important that the customer soon experiences a sense of achievement. The customer must have understood the offer and have confidence in working with the provider. The customer onboarding process must be outlined based on these goals. The following steps form a common basis for typical customer onboarding [5] [6] [7].

- First interaction: The first interaction is crucial for the start of the customer relationship. It is therefore important to understand the success criteria and make the first experience as positive as possible for the customer.

- Offer or product overview: The demonstration of the offer of products and services is again a very important point in customer onboarding and can be realized through explanations, a series of step-by-step videos or embedded presentations within the product. The aim is to motivate the consumer to take action.

- Product individualization: By now, the consumer probably knows the basics of the requested products or services, but not all the details and subtleties. In this step, the prospective customer's previous motivation to take action bears fruit. If it is a software solution, for example, the consumer uses the product on offer for the first time. Or the consumer configures the product or services individually according to their wishes. These activities must be supported by auxiliary materials and support.

- Registration: Registration, often referred to as check-in, is the first strong expression of interest and the start of the conversion. For this to be successful, further problems for the prospective customer must be identified and addressed or solved in such a way that any irritation is avoided until the purchase or contract is concluded.

- Initial success: But during registration, the product and provider gain credibility and trust for the consumer. Good timing in the sequence of touchpoints is important. If, for example, a consumer no longer logs in, it makes sense to send them an email asking what is stopping them from continuing, to make them an offer of help or to give them an incentive to continue customer onboarding.

- Application: This step is sometimes interwoven with registration, for example when an e-mail address or age information is requested. The application is often also an expression of a "shopping cart" with which the consumer wants to become a customer.

- Request: Now it is the provider's turn to ask questions about the application, for example by asking to confirm the e-mail address or age. For fee-based products or services, the payment method is also requested and specified in this step. In addition, the consumer is often asked to take note of the withdrawal policy and data protection provisions. On classic e-commerce sites, this step includes the "check-out" or "proceed to checkout".

- Confirmation: For legal reasons and to avoid misunderstandings, a summary of the previous entries is always necessary or useful.

- Signing: Sometimes it is just a click, sometimes a digital signature is required. The consumer must make a legally binding declaration of intent.

- Use: Once the consumer has officially become a customer by signing, customer onboarding ends. But only in principle. Customer satisfaction can be ensured through good support or the transmission of status reports. After all, the customer should come back.

Question from doubters: Can everything really be digitized?

Designing client onboarding in ten steps seems feasible. However, doubters are quick to ask further critical questions about digital customer onboarding:

- How should customer onboarding be digitized for products that require explanation?

- How can additional services, such as financing or insurance, be offered online and concluded in a legally binding manner?

- Can the necessary customer identification, which is sometimes required by law, be integrated into a digital customer onboarding process?

- How can necessary third parties, such as providers of credit information, be integrated into customer onboarding in such a way that the process is not interrupted?

- Digital and online contradicts the written form requirement, e.g. for credit agreements - what solution is there for this in digital customer onboarding?

Consumers are not interested in these questions. They expect the same convenience, speed and flexibility that they are used to from supposedly "simple" transactions, such as booking a flight. Technological progress, especially the right IT structure in the form of flexible SaaS components, allows solutions to these critical questions that dispel all concerns.

Example of a digital solution for complex issues

Digital customer onboarding also works for complex consumer requirements. Existing and proven IT technology, which afb uses successfully in practice, helps here. The following example shows this.

Clara-Marie, 27 years old, a doctoral student, belongs to the generation of digital natives. It's Sunday and she finally has time to choose the right kitchen for her new apartment. She doesn't mind that the kitchen studio is closed on Sundays, as she prefers to get information online anyway.

Information phase

Of course, Clara-Marie starts her search for a suitable offer on the internet via her smartphone, as she is currently traveling by train and wants to make good use of her time.

It is therefore not enough for providers to be present on the Internet with offers: The offers must be presented on all devices, from smartphones to widescreens, with a uniform user interface and identical user experience.

After all, Clara-Marie is flexible in the use of her devices and wants to continue the purchasing process on a larger screen when she gets home. It is therefore advisable to enable re-entry at the same process step after a deliberate interruption, e.g. by offering simple registration at an early stage.

Product presentation

Kitchens can be quite complicated. With interactive 3D implementations, Clara-Marie can assemble the modules so that they fit into her rooms without having to have CAD skills. This works even better with virtual reality, where you can view everything in the right dimensions and let it take effect on you.

Financing request

Clara-Marie actually wanted to pay for the kitchen in cash with the generous Christmas present from her grandparents. But the dream kitchen she put together using the configurator is more expensive than she thought. Disappointment leads to curiosity, so she clicks on the example financing offer that appears on her screen below the complete price. Curiosity turns into interest: The price-conscious doctoral student therefore wants to obtain a binding offer for her loan, as a general reference calculation won't help her at this point.

Software in the form of Intelligent Product Configuration & Calculation, for example, automatically creates an individually configurable financing offer. Financing restrictions can also be taken into account using the tool. Chatbots in the form of cognitive robo advisors help with any questions that arise in relation to financing.

Credit check

Financing often requires a credit check, which is carried out automatically by Intelligent Decision Automation. In this module, external information such as SCHUFA is integrated into afb's software. This avoids delays and requests for documents.

Identification

In the next step, Clara-Marie, the doctoral student, must clearly identify herself as Clara-Marie, the doctoral student. However, she doesn't have the time or inclination to run to the bank or to laboriously and time-consumingly compile the necessary documents. One solution is online identification using the video identification procedure. It is also possible to use the online ID function of the new ID card, also known as the eID function.

Now the financing bank just has to live up to the "know your customer" principle and rule out the possibility that Clara-Marie is up to something illegal by checking internal or external negative lists (PEP and sanctions lists) directly via the corresponding data service.

Digital signature

Since the eIDAS Regulation came into force, the fact that Clara-Marie still has to sign is no reason to interrupt the ordering process. A qualified electronic signature is sufficient for this, which can be carried out quickly and easily using a combination of an Internet browser and sending a TAN by SMS to a cell phone.

And Clara-Marie can look forward to the delivery of her perfect kitchen without ever having to enter a kitchen studio or a bank ...

Efficiency and customer expectations as drivers for customer onboarding

Is customer onboarding really the silver bullet for success in digital transformation that also meets customer expectations? Digital customer onboarding channels the positive forces of digital transformation and customer orientation into a concrete action plan.

However, this action plan is not so much a stroke of genius, but rather the combination of known findings from various topics. These are insights into inbound marketing, user experience, customer relationship management (CRM) and service orientation. Customer onboarding uses overlaps that occur between digitalization and customer orientation for the particularly important process of customer acquisition (company perspective) and customer acquisition (consumer perspective).

Is the royal road reserved only for kings? No, it is actually open to all companies. Digitalization has shifted the early customer touchpoints of almost all industries to the Internet, meaning that practically all companies have to think about redesigning their customer onboarding process. For companies that operate exclusively via the internet (internet pure players), digital customer onboarding is existential anyway; the same applies to companies with a multi-channel or omni-channel strategy for addressing customers. However, all other companies are also affected by digitalization and can benefit from investing in customer onboarding.

The realization of digital customer onboarding is definitely possible with the current state of IT. This applies to both simple contracts and complex transactions. Even for companies that are active in the B2B market, there is no escape, as the triumph of B2B marketplaces on the Internet shows. Consumers are used to maximum simplicity and are also transferring this expectation to complex sectors. IT services are already making it possible to meet these expectations.

The driver for improving digital customer onboarding is clearly technological progress. Companies must therefore set up their IT architecture in such a future-oriented way that technological innovations can be integrated as quickly as possible.

Sources

1 Kothari, Amit, Tallyfy (2018): Definition - What is Customer Onboarding? tallyfy.com/definition-customer-onboarding/

2 Marous, Jim, The Financial Brand (2018): 21 Steps to Building a Killer Onboarding Strategy in Banking (27.08.2014), thefinancialbrand.com/41840/new-customer-onboarding-success-banking/

3 Mohanty, Deepak, Cognizant (2013): Efficient Client Onboarding: The Key to Empowering Banks, www.cognizant.com/InsightsWhitepapers/Efficient-Client-Onboarding-The-Key-to-Empowering-Banks.pdf

4 Hendricks, Rost & Cie (2017). "Überlebensfaktor Kundenorientierung: Wie Unternehmen die Digitalisierung meistern" www.hrcie.com/nc/veroeffentlichungen/studie.html

5 Ramdas, Shreesha, Strikedeck: The Mechanics of Onboarding (28.06.2016), strikedeck.com/the-mechanics-of-onboarding/

6 Schroeder, Peter, northpass (2018): Six Steps to an Effective Customer Onboarding Program, www.northpass.com/blog/six-steps-to-an-effective-customer-onboarding-program

7 Hafeez, Samma,Thought Industries (2018): 7 Steps to the Perfect Customer Onboarding Program (13.06.2018), blog.thoughtindustries.com/new-blog/7-steps-to-the-perfect-customer-onboarding-program