Anyone who has ever paid for a car, a kitchen or even a trip on credit rather than cash has already had to deal with Retail Finance. Essentially, the idea is that some goods are simply too expensive for many consumers to pay for in cash. The seller sells a good or service that he would not have sold without the financing. The buyer acquires a good that he would not have been able to purchase without financing. In economic terms, a good is "sold" on the market thanks to financing, which explains the name.

There is little definition of the term "Retail Finance" on the World Wide Web. Wikipedia, for example, only devotes one sentence to the topic, whereas you can find much more comprehensive descriptions of related terms such as consumer credit or installment credit. As a rule, the authors on the Internet refrain from developing a generally valid term and instead focus directly on the various forms that are encountered in practice.

If you want to find out more about the term itself, you will therefore need to consult specialist or academic literature. According to this literature, Retail Finance refers to all sales policy measures that have the purpose of promoting the sale of products and services through financing [1].

The term financing brokerage used in this definition gives the impression that a product provider (e.g. a manufacturer or retail company) always brokers the financing. This may be legally correct, but in the perception of consumers this is not necessarily the case. For example, someone who purchases an Opel brand vehicle from an Opel dealership also receives Opel brand financing. They therefore receive their Retail Finance "from Opel" - even if a transaction is actually brokered by Opel Bank GmbH. This is a typical example of a so-called captive in the automotive sector. Car manufacturers have established financing companies as independent legal or organizational units in order to supply the manufacturer's dealer network with funds and thus promote sales of their own brand. With this in mind, we prefer the term "provide" to "arrange" and therefore work with the following definition: Retail Finance refers to all sales policy measures that have the purpose of promoting sales by providing funding.

The most important sector for Retail Finance was and is the automotive industry. The "car loan" continues to enjoy great popularity. According to a survey conducted by TARGOBANK in 2016, almost half of Germans are planning to finance their next vehicle [2]. This makes it clear: even in the digital age, customer orientation requires traditional elements such as Retail Finance.

The dominance of the motor vehicle sector can be explained by the fact that demand for car loans in this segment has been unbroken for decades. However, the high demand has also been easy to meet for a long time. Secondly, from the provider's point of view, this is a largely standardized business with high sales volumes and considerable batch sizes. This has a favorable impact on the expected return on investment. As a result, Retail Finance for motor vehicles at the point of sale (POS) became a success story many decades ago.

Although not as important as the automotive sector, the financing of furniture, kitchens and electrical and entertainment goods has been around for a long time. In the sales financing sector, these are known by the somewhat antiquated terms "brown goods" and "white goods". As IT solutions have become increasingly automated and consumers have become more open to innovative financing models, Retail Finance has continued to conquer new sectors. Recent examples include Retail Finance for dental prostheses, cosmetic surgery and vacation travel.

Retail Finance therefore offers advantages for all parties involved. The manufacturer, who sells his products via dealers, ensures that customers can also finance them at the time of purchase, e.g. via an installment loan or leasing from an affiliated financing company.

The advantage for the customer lies in owning a product that they could not or do not want to pay for in cash. Retailers benefit from an improvement in returns, as larger volumes can be sold due to the promotional effect and commissions for providing the financing can be booked.

In practice, the terms "Retail Finance", "Retail Finance", "Sales Finance" or "POS Finance" are used synonymously.

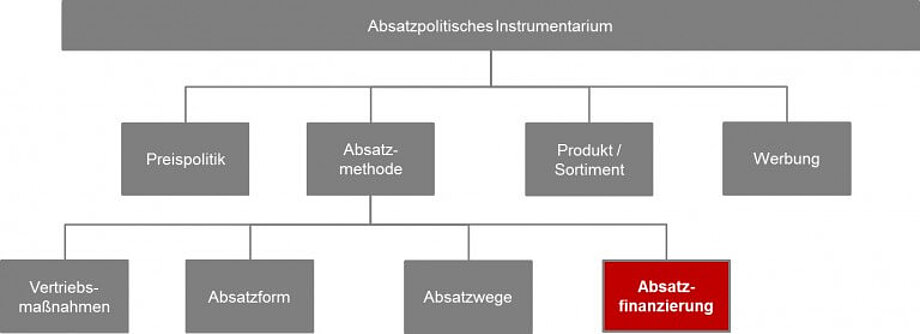

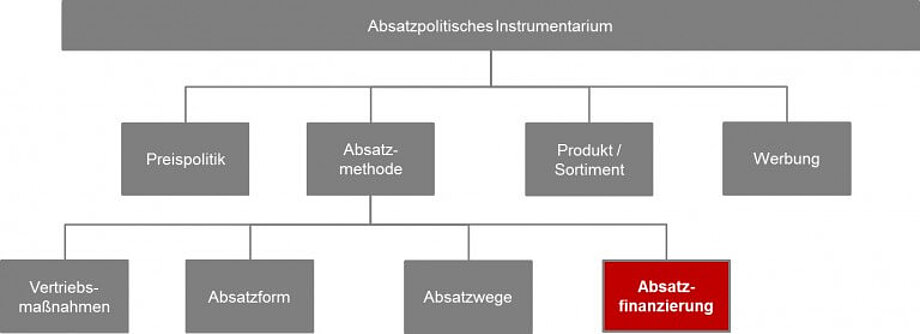

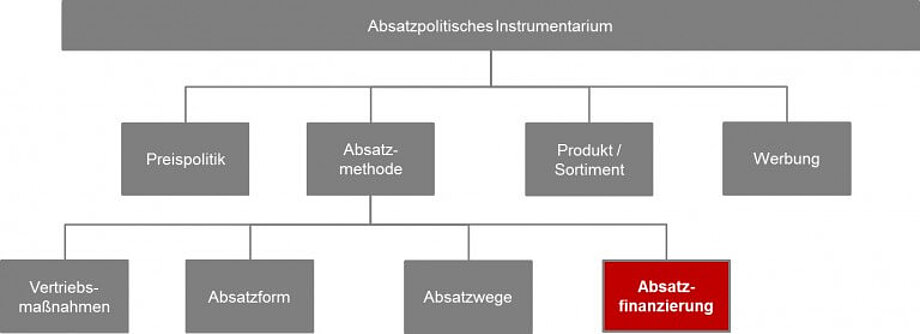

From an academic point of view, Retail Finance is part of the sales policy instruments used by manufacturers and retailers. The term "sales management" has been somewhat forgotten. Sales management used to be an integral part of every business administration course. In the age of saturated markets, the increasing power of brands and the expansion of marketing management, sales management has been increasingly replaced by marketing chairs. For this reason, the sales policy instruments are explicitly presented here once again:

Figure 1: Classification of Retail Finance based on Bittmann, Helmut and Kirstein, Gerrit [3]

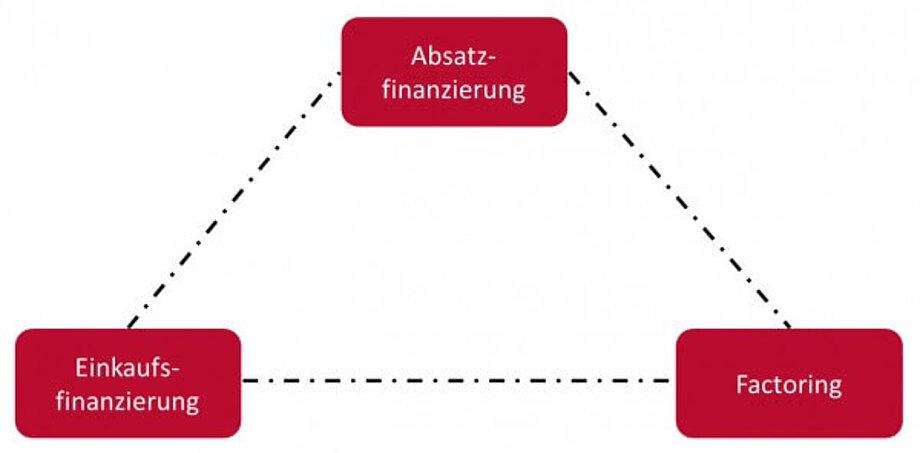

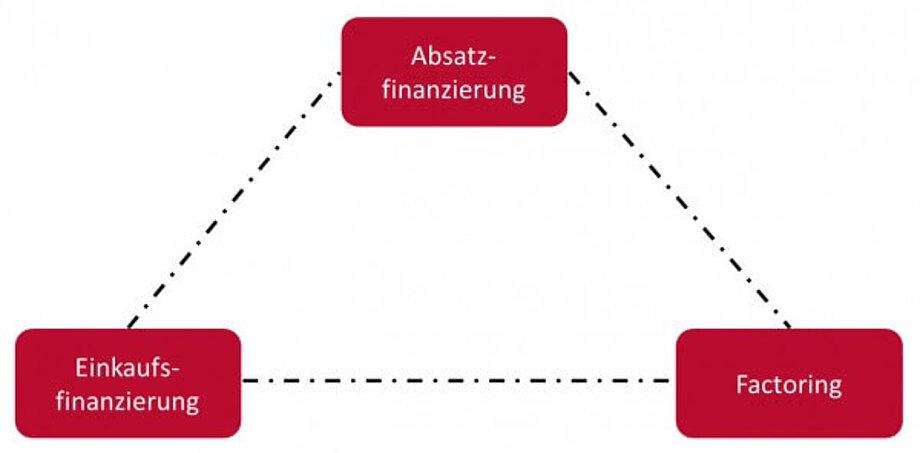

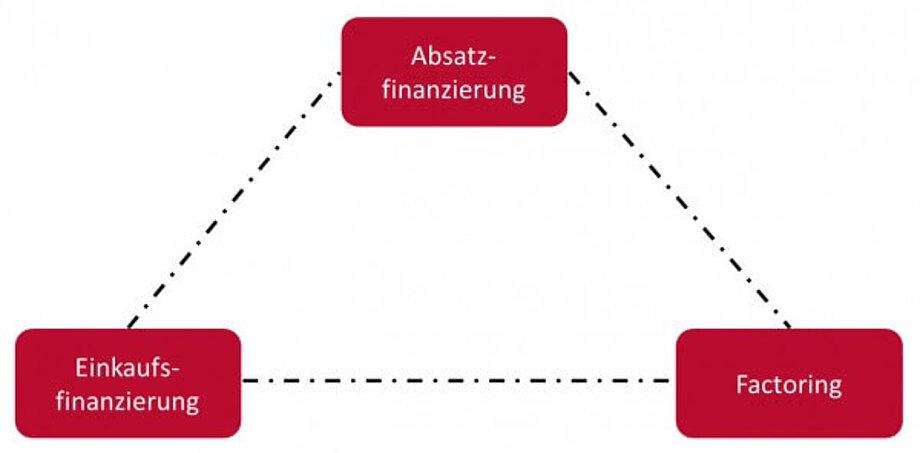

In practice, Retail Finance is often used in conjunction with Wholesale Finance and Factoring. How do these forms of financing relate to each other?

Figure 2: Three typical financing alternatives for financing the flow of goods

As there are numerous sub-forms and special variants of all three forms of financing, a complete systematization would go too far at this point. For this reason, only the essence of the respective financing instrument will be outlined here.

The central common feature is that all three financing instruments have a strong logical connection with a primary transaction (purchase of goods or services). In the private customer environment, this can be, for example, the purchase of a new kitchen, furniture, a vehicle or even a trip. Examples for the business customer sector include machinery or other fixed assets. From the retailer's point of view, the forms of financing interact as follows in simplified terms:

Wholesale finance makes it easier for retailers to stock the POS by providing access to financing where the retailer's stock is secured. This lays the foundation for successful sales at the POS, as people still like to inspect certain products live, even in the age of online shopping. Once the customer has decided to make a purchase, Retail Finance comes into play: it makes it possible to serve the customer at the moment the desire to buy arises, even if the customer does not have the necessary liquidity at that time. As an alternative financing instrument (e.g. as an alternative to a house bank loan or current account), factoring rounds off the financing options available to retailers and is a further building block for ensuring their liquidity.

The economic importance of Retail Finance cannot be overestimated due to its sales-promoting effect. "The market for automotive financial services has matured into an economically significant growth market. Currently, around 75 percent of all new private and commercial car registrations in Germany are brought onto the road via leasing and financing models. This corresponds to an annual credit volume of around 47.7 billion euros [4]."

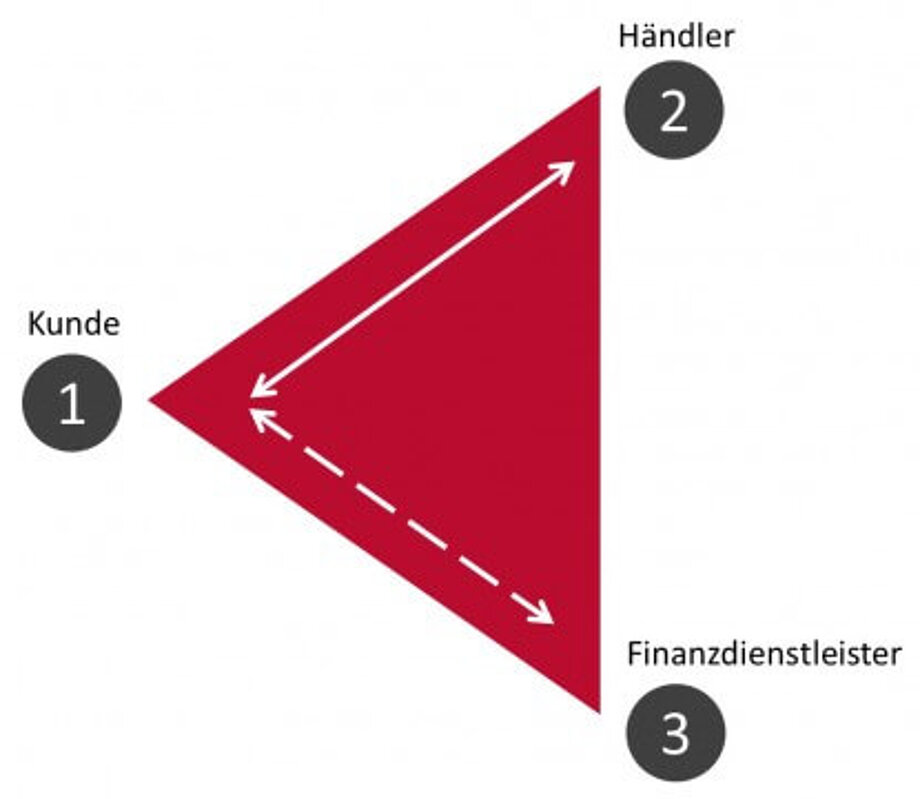

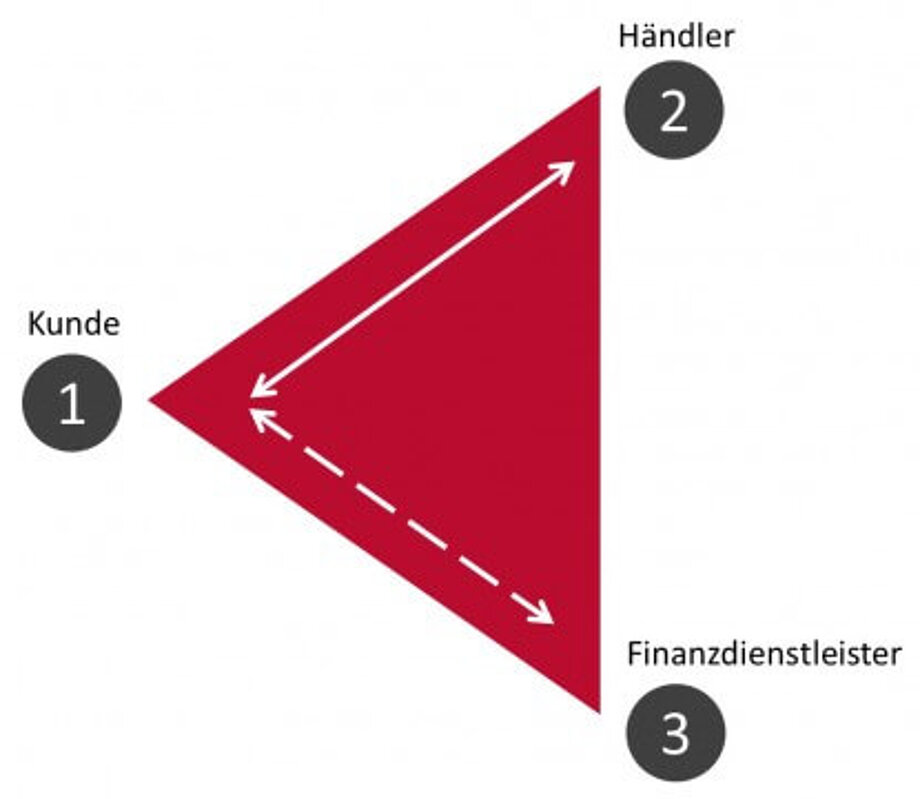

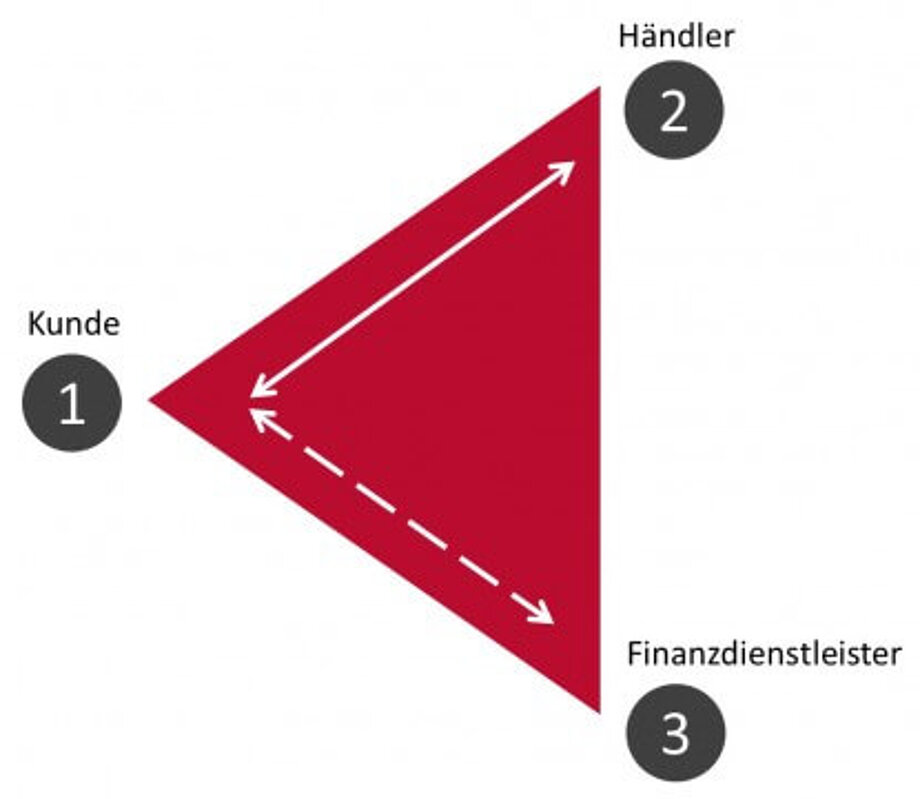

The following constellation in Retail Finance is generally known and easily recognizable from the outside:

Figure 3: Retail Finance from a general perspective

The manufacturer that sells its products via dealers ensures that customers can also finance them at the time of purchase, e.g. via an installment loan or leasing.

For the customer, only the transaction with the retailer is usually obvious. They receive the desired product (e.g. a vehicle) and a suitable installment loan. They only become aware that they are actually entering into a transaction with a financial service provider during the financial transaction. The extent to which the constellation between retailer and financial service provider is disclosed depends on many factors. Marketing considerations, for example, play a role here. Manufacturers/retailers with very strong brands usually emphasize these during the financing process. If a manufacturer/retailer expects an advantage from the financial service provider's brand (e.g. a trust bonus), the connection to this financial service provider is often disclosed in communication.

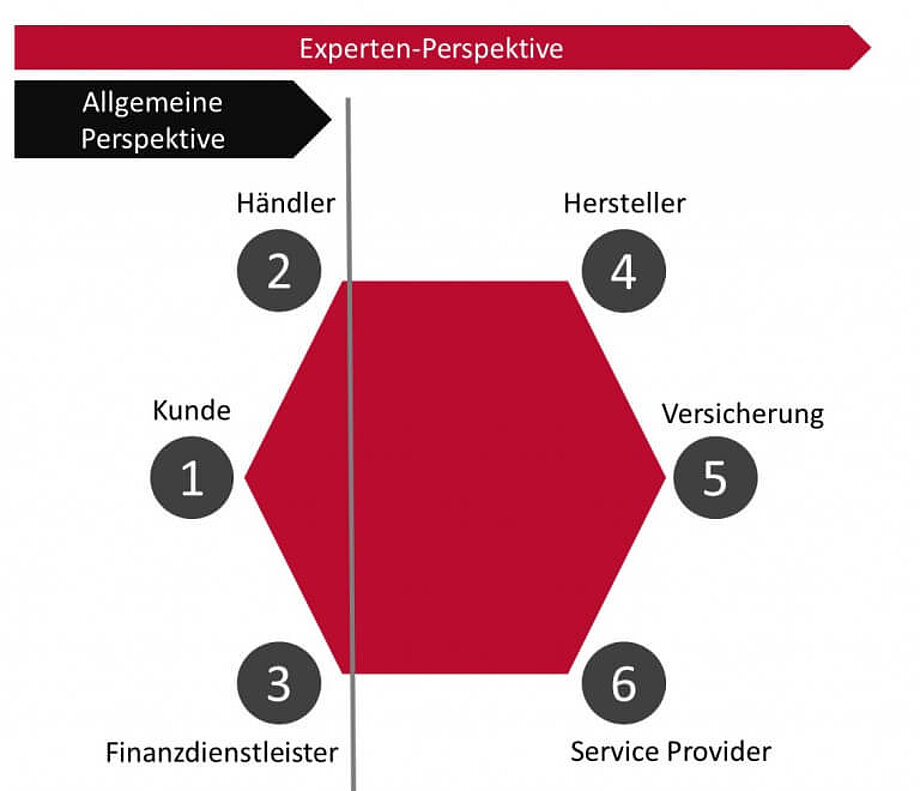

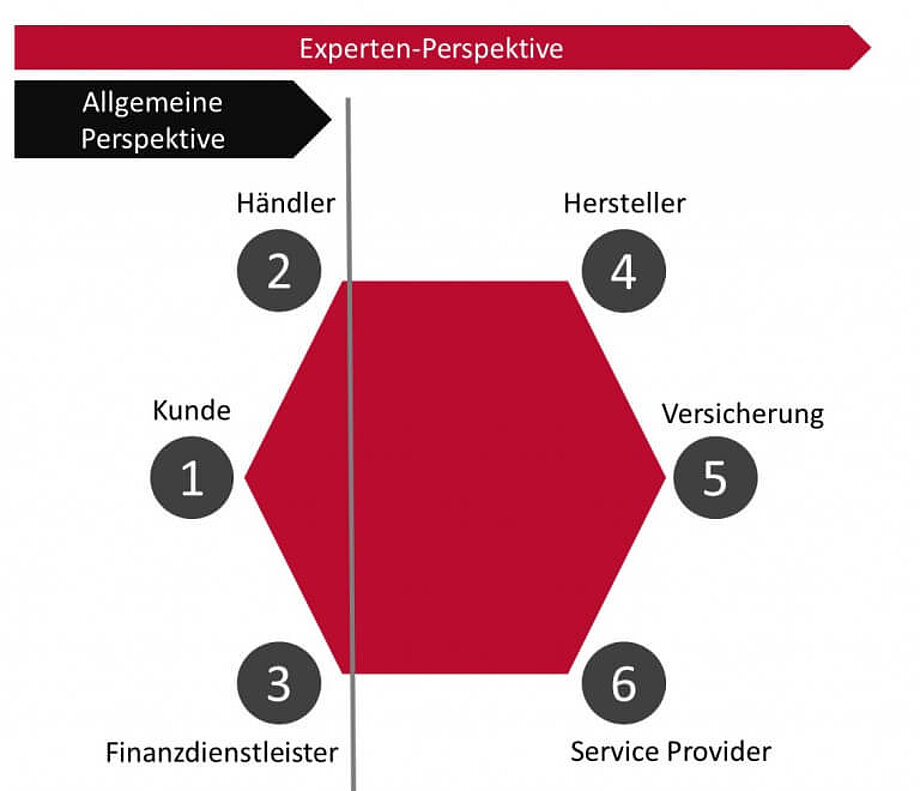

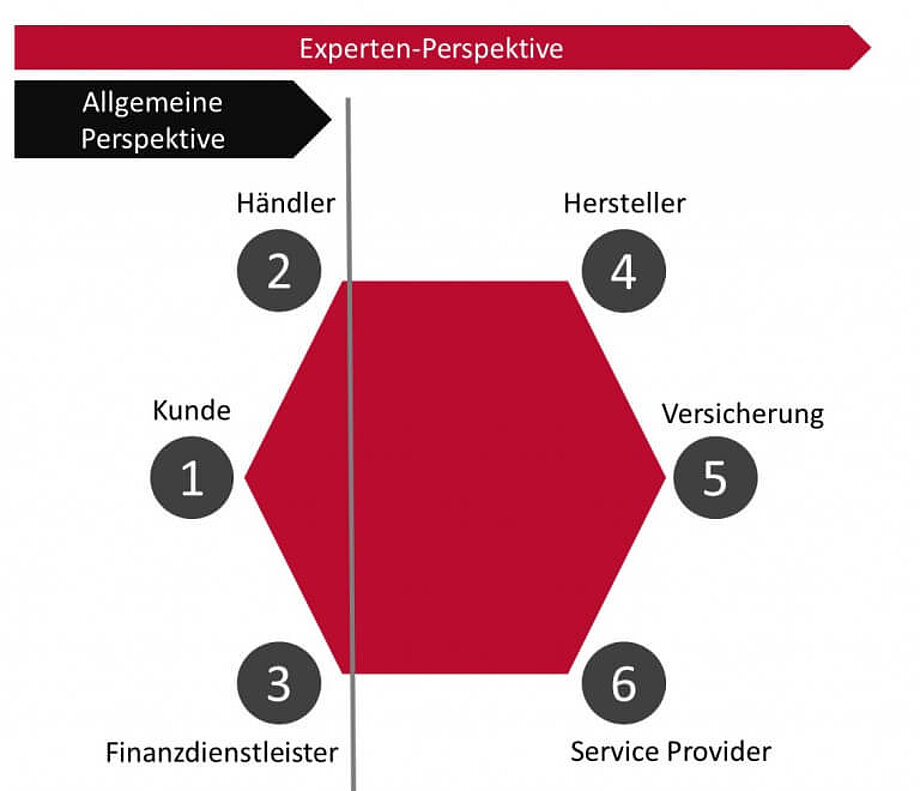

However, behind the generally known triangular relationship between customer, retailer and financial service provider, there is actually another triangle: after all, the manufacturer of the product is also indirectly involved in the transaction. The same applies to insurance, for example, where the provider of residual debt insurance is involved in the transaction. Finally, there are special service providers for additional services, such as mobility guarantees and tire services. This turns the Retail Finance triangle into a hexagon.

Figure 4: Retail Finance from an expert perspective

The customer who buys a product thus becomes part of a complex interplay of six perfectly coordinated participants.

Just as complex as the determination of market figures is the investigation of which side initiates Retail Finance. At this point, three selected constellations are used to draw attention to the different possibilities.

Constellation 1: Financial service providers (e.g. banks or leasing companies) operate the sales financing business largely independently of manufacturers or retailers. These are so-called "independent sales financiers". In this constellation, the impetus comes from the financial side. Financial service providers themselves determine which products and services they finance from which providers (manufacturers/retailers). Accordingly, they try to acquire partners from the product side (manufacturers/retailers). A typical example of this is TARGOBANK, a long-standing customer of afb.

Constellation 2: Here, the impetus comes from the manufacturer side, e.g. from financially strong industrial groups. They establish or acquire a bank (captive) linked to their own company with the aim of expanding their financing and liquidity management options. In this sense, captives often take on the role of sales financier. The best-known captives can be found in the automotive industry, such as afb's client Honda Bank.

Constellation 3: However, the impetus for Retail Finance on the part of product providers does not necessarily have to come from the manufacturer. It can also be strong retail units (e.g. retail chains or retail associations with a lot of market power) that become active. You can also promote your sales by networking with an appropriate financing partner. In this case, the influence of the underlying product manufacturers is largely ignored. One example of this constellation is the afb customer CRONBANK in conjunction with the MHK Group.

Finally, it should be noted that it is not possible to derive a general rule for how Retail Finance is created. Although there are focal points and recurring patterns, the closely interlinked value chains of the six players on the one hand and the individuality of the interests on the other ensure that there are always new and exciting constellations.

Sources

1 Bittmann, Helmut and Kirstein, Gerrit, Retail Finance, GEFA 2008, p.4

2 TARGOBANK (2016). Car purchase study: Every third person wants to buy a car in 2016. URL: www.presseportal.de/pm/78980/3230726

3 Bittmann, Helmut and Kirstein, Gerrit, Retail Finance, GEFA 2008, p.5

4 AKA Arbeitskreis der Banken und Leasinggesellschaften der Automobilwirtschaft (2016). Automotive banks 2016 (study), p. 2

Anyone who has ever paid for a car, a kitchen or even a trip on credit rather than cash has already had to deal with Retail Finance. Essentially, the idea is that some goods are simply too expensive for many consumers to pay for in cash. The seller sells a good or service that he would not have sold without the financing. The buyer acquires a good that he would not have been able to purchase without financing. In economic terms, a good is "sold" on the market thanks to financing, which explains the name.

There is little definition of the term "Retail Finance" on the World Wide Web. Wikipedia, for example, only devotes one sentence to the topic, whereas you can find much more comprehensive descriptions of related terms such as consumer credit or installment credit. As a rule, the authors on the Internet refrain from developing a generally valid term and instead focus directly on the various forms that are encountered in practice.

If you want to find out more about the term itself, you will therefore need to consult specialist or academic literature. According to this literature, Retail Finance refers to all sales policy measures that have the purpose of promoting the sale of products and services through financing [1].

The term financing brokerage used in this definition gives the impression that a product provider (e.g. a manufacturer or retail company) always brokers the financing. This may be legally correct, but in the perception of consumers this is not necessarily the case. For example, someone who purchases an Opel brand vehicle from an Opel dealership also receives Opel brand financing. They therefore receive their Retail Finance "from Opel" - even if a transaction is actually brokered by Opel Bank GmbH. This is a typical example of a so-called captive in the automotive sector. Car manufacturers have established financing companies as independent legal or organizational units in order to supply the manufacturer's dealer network with funds and thus promote sales of their own brand. With this in mind, we prefer the term "provide" to "arrange" and therefore work with the following definition: Retail Finance refers to all sales policy measures that have the purpose of promoting sales by providing funding.

The most important sector for Retail Finance was and is the automotive industry. The "car loan" continues to enjoy great popularity. According to a survey conducted by TARGOBANK in 2016, almost half of Germans are planning to finance their next vehicle [2]. This makes it clear: even in the digital age, customer orientation requires traditional elements such as Retail Finance.

The dominance of the motor vehicle sector can be explained by the fact that demand for car loans in this segment has been unbroken for decades. However, the high demand has also been easy to meet for a long time. Secondly, from the provider's point of view, this is a largely standardized business with high sales volumes and considerable batch sizes. This has a favorable impact on the expected return on investment. As a result, Retail Finance for motor vehicles at the point of sale (POS) became a success story many decades ago.

Although not as important as the automotive sector, the financing of furniture, kitchens and electrical and entertainment goods has been around for a long time. In the sales financing sector, these are known by the somewhat antiquated terms "brown goods" and "white goods". As IT solutions have become increasingly automated and consumers have become more open to innovative financing models, Retail Finance has continued to conquer new sectors. Recent examples include Retail Finance for dental prostheses, cosmetic surgery and vacation travel.

Retail Finance therefore offers advantages for all parties involved. The manufacturer, who sells his products via dealers, ensures that customers can also finance them at the time of purchase, e.g. via an installment loan or leasing from an affiliated financing company.

The advantage for the customer lies in owning a product that they could not or do not want to pay for in cash. Retailers benefit from an improvement in returns, as larger volumes can be sold due to the promotional effect and commissions for providing the financing can be booked.

In practice, the terms "Retail Finance", "Retail Finance", "Sales Finance" or "POS Finance" are used synonymously.

From an academic point of view, Retail Finance is part of the sales policy instruments used by manufacturers and retailers. The term "sales management" has been somewhat forgotten. Sales management used to be an integral part of every business administration course. In the age of saturated markets, the increasing power of brands and the expansion of marketing management, sales management has been increasingly replaced by marketing chairs. For this reason, the sales policy instruments are explicitly presented here once again:

Figure 1: Classification of Retail Finance based on Bittmann, Helmut and Kirstein, Gerrit [3]

In practice, Retail Finance is often used in conjunction with Wholesale Finance and Factoring. How do these forms of financing relate to each other?

Figure 2: Three typical financing alternatives for financing the flow of goods

As there are numerous sub-forms and special variants of all three forms of financing, a complete systematization would go too far at this point. For this reason, only the essence of the respective financing instrument will be outlined here.

The central common feature is that all three financing instruments have a strong logical connection with a primary transaction (purchase of goods or services). In the private customer environment, this can be, for example, the purchase of a new kitchen, furniture, a vehicle or even a trip. Examples for the business customer sector include machinery or other fixed assets. From the retailer's point of view, the forms of financing interact as follows in simplified terms:

Wholesale finance makes it easier for retailers to stock the POS by providing access to financing where the retailer's stock is secured. This lays the foundation for successful sales at the POS, as people still like to inspect certain products live, even in the age of online shopping. Once the customer has decided to make a purchase, Retail Finance comes into play: it makes it possible to serve the customer at the moment the desire to buy arises, even if the customer does not have the necessary liquidity at that time. As an alternative financing instrument (e.g. as an alternative to a house bank loan or current account), factoring rounds off the financing options available to retailers and is a further building block for ensuring their liquidity.

The economic importance of Retail Finance cannot be overestimated due to its sales-promoting effect. "The market for automotive financial services has matured into an economically significant growth market. Currently, around 75 percent of all new private and commercial car registrations in Germany are brought onto the road via leasing and financing models. This corresponds to an annual credit volume of around 47.7 billion euros [4]."

The following constellation in Retail Finance is generally known and easily recognizable from the outside:

Figure 3: Retail Finance from a general perspective

The manufacturer that sells its products via dealers ensures that customers can also finance them at the time of purchase, e.g. via an installment loan or leasing.

For the customer, only the transaction with the retailer is usually obvious. They receive the desired product (e.g. a vehicle) and a suitable installment loan. They only become aware that they are actually entering into a transaction with a financial service provider during the financial transaction. The extent to which the constellation between retailer and financial service provider is disclosed depends on many factors. Marketing considerations, for example, play a role here. Manufacturers/retailers with very strong brands usually emphasize these during the financing process. If a manufacturer/retailer expects an advantage from the financial service provider's brand (e.g. a trust bonus), the connection to this financial service provider is often disclosed in communication.

However, behind the generally known triangular relationship between customer, retailer and financial service provider, there is actually another triangle: after all, the manufacturer of the product is also indirectly involved in the transaction. The same applies to insurance, for example, where the provider of residual debt insurance is involved in the transaction. Finally, there are special service providers for additional services, such as mobility guarantees and tire services. This turns the Retail Finance triangle into a hexagon.

Figure 4: Retail Finance from an expert perspective

The customer who buys a product thus becomes part of a complex interplay of six perfectly coordinated participants.

Just as complex as the determination of market figures is the investigation of which side initiates Retail Finance. At this point, three selected constellations are used to draw attention to the different possibilities.

Constellation 1: Financial service providers (e.g. banks or leasing companies) operate the sales financing business largely independently of manufacturers or retailers. These are so-called "independent sales financiers". In this constellation, the impetus comes from the financial side. Financial service providers themselves determine which products and services they finance from which providers (manufacturers/retailers). Accordingly, they try to acquire partners from the product side (manufacturers/retailers). A typical example of this is TARGOBANK, a long-standing customer of afb.

Constellation 2: Here, the impetus comes from the manufacturer side, e.g. from financially strong industrial groups. They establish or acquire a bank (captive) linked to their own company with the aim of expanding their financing and liquidity management options. In this sense, captives often take on the role of sales financier. The best-known captives can be found in the automotive industry, such as afb's client Honda Bank.

Constellation 3: However, the impetus for Retail Finance on the part of product providers does not necessarily have to come from the manufacturer. It can also be strong retail units (e.g. retail chains or retail associations with a lot of market power) that become active. You can also promote your sales by networking with an appropriate financing partner. In this case, the influence of the underlying product manufacturers is largely ignored. One example of this constellation is the afb customer CRONBANK in conjunction with the MHK Group.

Finally, it should be noted that it is not possible to derive a general rule for how Retail Finance is created. Although there are focal points and recurring patterns, the closely interlinked value chains of the six players on the one hand and the individuality of the interests on the other ensure that there are always new and exciting constellations.

Sources

1 Bittmann, Helmut and Kirstein, Gerrit, Retail Finance, GEFA 2008, p.4

2 TARGOBANK (2016). Car purchase study: Every third person wants to buy a car in 2016. URL: www.presseportal.de/pm/78980/3230726

3 Bittmann, Helmut and Kirstein, Gerrit, Retail Finance, GEFA 2008, p.5

4 AKA Arbeitskreis der Banken und Leasinggesellschaften der Automobilwirtschaft (2016). Automotive banks 2016 (study), p. 2

Anyone who has ever paid for a car, a kitchen or even a trip on credit rather than cash has already had to deal with Retail Finance. Essentially, the idea is that some goods are simply too expensive for many consumers to pay for in cash. The seller sells a good or service that he would not have sold without the financing. The buyer acquires a good that he would not have been able to purchase without financing. In economic terms, a good is "sold" on the market thanks to financing, which explains the name.

There is little definition of the term "Retail Finance" on the World Wide Web. Wikipedia, for example, only devotes one sentence to the topic, whereas you can find much more comprehensive descriptions of related terms such as consumer credit or installment credit. As a rule, the authors on the Internet refrain from developing a generally valid term and instead focus directly on the various forms that are encountered in practice.

If you want to find out more about the term itself, you will therefore need to consult specialist or academic literature. According to this literature, Retail Finance refers to all sales policy measures that have the purpose of promoting the sale of products and services through financing [1].

The term financing brokerage used in this definition gives the impression that a product provider (e.g. a manufacturer or retail company) always brokers the financing. This may be legally correct, but in the perception of consumers this is not necessarily the case. For example, someone who purchases an Opel brand vehicle from an Opel dealership also receives Opel brand financing. They therefore receive their Retail Finance "from Opel" - even if a transaction is actually brokered by Opel Bank GmbH. This is a typical example of a so-called captive in the automotive sector. Car manufacturers have established financing companies as independent legal or organizational units in order to supply the manufacturer's dealer network with funds and thus promote sales of their own brand. With this in mind, we prefer the term "provide" to "arrange" and therefore work with the following definition: Retail Finance refers to all sales policy measures that have the purpose of promoting sales by providing funding.

The most important sector for Retail Finance was and is the automotive industry. The "car loan" continues to enjoy great popularity. According to a survey conducted by TARGOBANK in 2016, almost half of Germans are planning to finance their next vehicle [2]. This makes it clear: even in the digital age, customer orientation requires traditional elements such as Retail Finance.

The dominance of the motor vehicle sector can be explained by the fact that demand for car loans in this segment has been unbroken for decades. However, the high demand has also been easy to meet for a long time. Secondly, from the provider's point of view, this is a largely standardized business with high sales volumes and considerable batch sizes. This has a favorable impact on the expected return on investment. As a result, Retail Finance for motor vehicles at the point of sale (POS) became a success story many decades ago.

Although not as important as the automotive sector, the financing of furniture, kitchens and electrical and entertainment goods has been around for a long time. In the sales financing sector, these are known by the somewhat antiquated terms "brown goods" and "white goods". As IT solutions have become increasingly automated and consumers have become more open to innovative financing models, Retail Finance has continued to conquer new sectors. Recent examples include Retail Finance for dental prostheses, cosmetic surgery and vacation travel.

Retail Finance therefore offers advantages for all parties involved. The manufacturer, who sells his products via dealers, ensures that customers can also finance them at the time of purchase, e.g. via an installment loan or leasing from an affiliated financing company.

The advantage for the customer lies in owning a product that they could not or do not want to pay for in cash. Retailers benefit from an improvement in returns, as larger volumes can be sold due to the promotional effect and commissions for providing the financing can be booked.

In practice, the terms "Retail Finance", "Retail Finance", "Sales Finance" or "POS Finance" are used synonymously.

From an academic point of view, Retail Finance is part of the sales policy instruments used by manufacturers and retailers. The term "sales management" has been somewhat forgotten. Sales management used to be an integral part of every business administration course. In the age of saturated markets, the increasing power of brands and the expansion of marketing management, sales management has been increasingly replaced by marketing chairs. For this reason, the sales policy instruments are explicitly presented here once again:

Figure 1: Classification of Retail Finance based on Bittmann, Helmut and Kirstein, Gerrit [3]

In practice, Retail Finance is often used in conjunction with Wholesale Finance and Factoring. How do these forms of financing relate to each other?

Figure 2: Three typical financing alternatives for financing the flow of goods

As there are numerous sub-forms and special variants of all three forms of financing, a complete systematization would go too far at this point. For this reason, only the essence of the respective financing instrument will be outlined here.

The central common feature is that all three financing instruments have a strong logical connection with a primary transaction (purchase of goods or services). In the private customer environment, this can be, for example, the purchase of a new kitchen, furniture, a vehicle or even a trip. Examples for the business customer sector include machinery or other fixed assets. From the retailer's point of view, the forms of financing interact as follows in simplified terms:

Wholesale finance makes it easier for retailers to stock the POS by providing access to financing where the retailer's stock is secured. This lays the foundation for successful sales at the POS, as people still like to inspect certain products live, even in the age of online shopping. Once the customer has decided to make a purchase, Retail Finance comes into play: it makes it possible to serve the customer at the moment the desire to buy arises, even if the customer does not have the necessary liquidity at that time. As an alternative financing instrument (e.g. as an alternative to a house bank loan or current account), factoring rounds off the financing options available to retailers and is a further building block for ensuring their liquidity.

The economic importance of Retail Finance cannot be overestimated due to its sales-promoting effect. "The market for automotive financial services has matured into an economically significant growth market. Currently, around 75 percent of all new private and commercial car registrations in Germany are brought onto the road via leasing and financing models. This corresponds to an annual credit volume of around 47.7 billion euros [4]."

The following constellation in Retail Finance is generally known and easily recognizable from the outside:

Figure 3: Retail Finance from a general perspective

The manufacturer that sells its products via dealers ensures that customers can also finance them at the time of purchase, e.g. via an installment loan or leasing.

For the customer, only the transaction with the retailer is usually obvious. They receive the desired product (e.g. a vehicle) and a suitable installment loan. They only become aware that they are actually entering into a transaction with a financial service provider during the financial transaction. The extent to which the constellation between retailer and financial service provider is disclosed depends on many factors. Marketing considerations, for example, play a role here. Manufacturers/retailers with very strong brands usually emphasize these during the financing process. If a manufacturer/retailer expects an advantage from the financial service provider's brand (e.g. a trust bonus), the connection to this financial service provider is often disclosed in communication.

However, behind the generally known triangular relationship between customer, retailer and financial service provider, there is actually another triangle: after all, the manufacturer of the product is also indirectly involved in the transaction. The same applies to insurance, for example, where the provider of residual debt insurance is involved in the transaction. Finally, there are special service providers for additional services, such as mobility guarantees and tire services. This turns the Retail Finance triangle into a hexagon.

Figure 4: Retail Finance from an expert perspective

The customer who buys a product thus becomes part of a complex interplay of six perfectly coordinated participants.

Just as complex as the determination of market figures is the investigation of which side initiates Retail Finance. At this point, three selected constellations are used to draw attention to the different possibilities.

Constellation 1: Financial service providers (e.g. banks or leasing companies) operate the sales financing business largely independently of manufacturers or retailers. These are so-called "independent sales financiers". In this constellation, the impetus comes from the financial side. Financial service providers themselves determine which products and services they finance from which providers (manufacturers/retailers). Accordingly, they try to acquire partners from the product side (manufacturers/retailers). A typical example of this is TARGOBANK, a long-standing customer of afb.

Constellation 2: Here, the impetus comes from the manufacturer side, e.g. from financially strong industrial groups. They establish or acquire a bank (captive) linked to their own company with the aim of expanding their financing and liquidity management options. In this sense, captives often take on the role of sales financier. The best-known captives can be found in the automotive industry, such as afb's client Honda Bank.

Constellation 3: However, the impetus for Retail Finance on the part of product providers does not necessarily have to come from the manufacturer. It can also be strong retail units (e.g. retail chains or retail associations with a lot of market power) that become active. You can also promote your sales by networking with an appropriate financing partner. In this case, the influence of the underlying product manufacturers is largely ignored. One example of this constellation is the afb customer CRONBANK in conjunction with the MHK Group.

Finally, it should be noted that it is not possible to derive a general rule for how Retail Finance is created. Although there are focal points and recurring patterns, the closely interlinked value chains of the six players on the one hand and the individuality of the interests on the other ensure that there are always new and exciting constellations.

Sources

1 Bittmann, Helmut and Kirstein, Gerrit, Retail Finance, GEFA 2008, p.4

2 TARGOBANK (2016). Car purchase study: Every third person wants to buy a car in 2016. URL: www.presseportal.de/pm/78980/3230726

3 Bittmann, Helmut and Kirstein, Gerrit, Retail Finance, GEFA 2008, p.5

4 AKA Arbeitskreis der Banken und Leasinggesellschaften der Automobilwirtschaft (2016). Automotive banks 2016 (study), p. 2